Joachim Kuczynski, 05 October 2025

Standard Evaluation

In this post I would like to explain how to evaluate a financial lease contract. Most lease contracts in economic life are financial lease ones. Financial lease payments are fixed obligations equivalent to debt service. Financial lease is just another way of borrowing money to pay for an asset. I provide an example to explain the standard evaluation procedure.

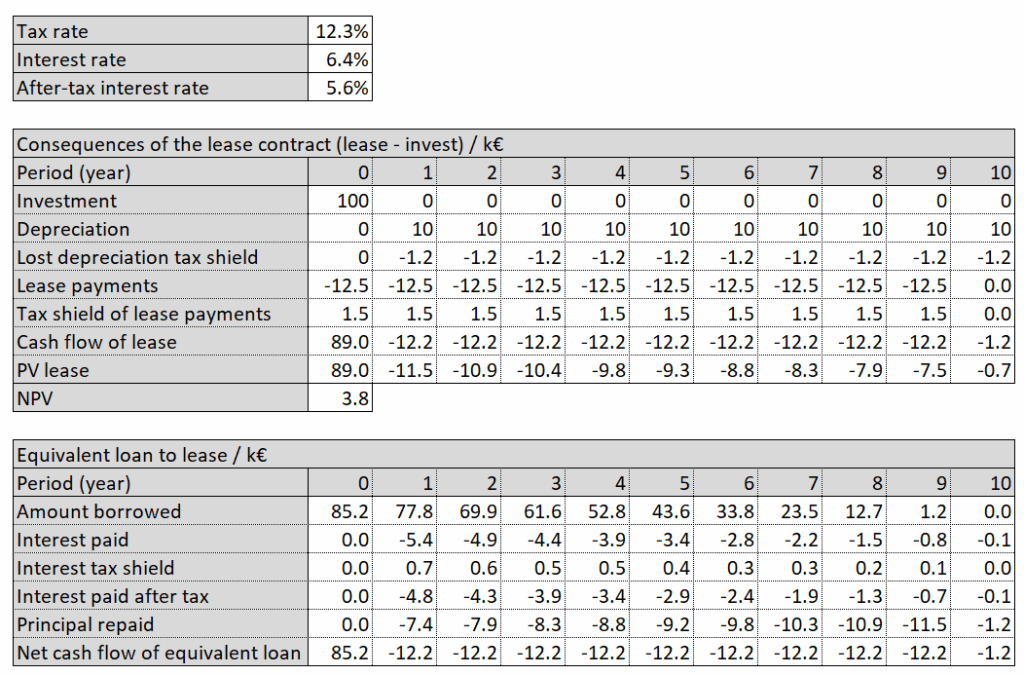

We want to decide whether it is better to make an investment ![]() of 100 thousand Euro (k€) or to lease it with annual payments of 12.5 k€. The investment is usable for 10 years and has a no salvage value. The lease payments have to be done in advance and are constant over 10 years. In the table below you can see the consequences of leasing the asset compared to make the investment. Leasing reduces your depreciation, and as a consequence the tax shield because of depreciation is lost. On the other hand the lease payments are fully tax-deductible. We discount the cash flows by the company’s borrowing rate. We can deduct the interest payments from the taxable income. Hence the net cost of borrowing is the after-tax interest rate. So the after-tax interest rate is the effective rate at which a company can transfer debt-equivalent cash flows from one time period to another. With an interest rate

of 100 thousand Euro (k€) or to lease it with annual payments of 12.5 k€. The investment is usable for 10 years and has a no salvage value. The lease payments have to be done in advance and are constant over 10 years. In the table below you can see the consequences of leasing the asset compared to make the investment. Leasing reduces your depreciation, and as a consequence the tax shield because of depreciation is lost. On the other hand the lease payments are fully tax-deductible. We discount the cash flows by the company’s borrowing rate. We can deduct the interest payments from the taxable income. Hence the net cost of borrowing is the after-tax interest rate. So the after-tax interest rate is the effective rate at which a company can transfer debt-equivalent cash flows from one time period to another. With an interest rate ![]() , a tax rate

, a tax rate ![]() and (to investment) differing leasing cash flows

and (to investment) differing leasing cash flows ![]() we get the net value of lease

we get the net value of lease ![]() :

:

![]()

![]() means that leasing is better than doing the investment,

means that leasing is better than doing the investment, ![]() indicates that leasing is worse than investing.

indicates that leasing is worse than investing.

In an additional table you can see the calculation of the equivalent loan leading to the same cash flows as the leasing contract. In our example ![]() is 3.8 k€. That means that leasing is better than investing and should be preferred.

is 3.8 k€. That means that leasing is better than investing and should be preferred.

![]() can be a single investment value, but also the NPV of an investment cash flow sequence, discounted by the debt interest rate. You can also take yearly investment cash flows .

can be a single investment value, but also the NPV of an investment cash flow sequence, discounted by the debt interest rate. You can also take yearly investment cash flows .

In general you should take care whether the company can really receive full tax shield and whether payments in a yearly time scale is sufficiently precise. If you have additional cash flows for maintenance, insurance, salvage value, etc., you can simply add it to the cash flows. The procedure remains the same.

Maintenance and salvage value are harder to predict than the other cash flows. If the risk, or volatility respectively, is significantly higher it might be better to discount them with a higher, risk-adjusted discount rate. CAPM helps to provide appropriate discount rates.

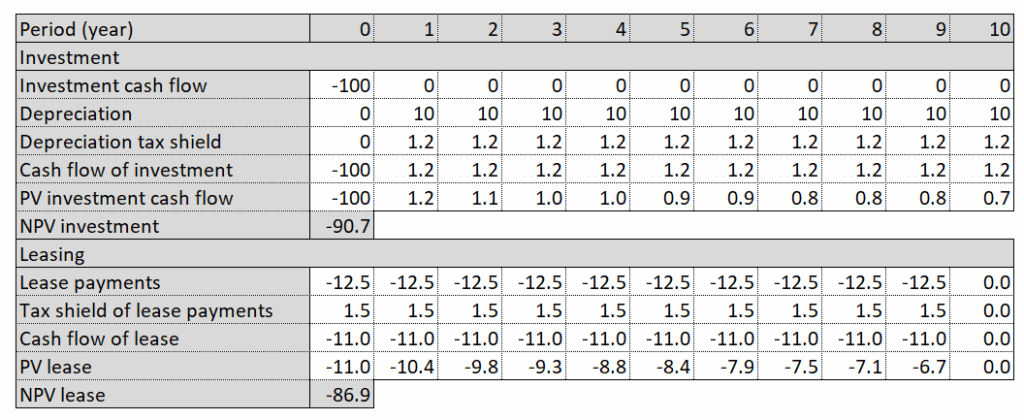

Separation and Project Implementation

Next we want to seperate the investment and leasing scenario. This must lead to the same result, because the present values are additive and separable. In the following table the investment and leasing scenarios are evaluated by their own. The result ist the same, NPV of financial leasing is 8.3 k€ better than investing.

Let ![]() be the investment scenario cash flow and

be the investment scenario cash flow and ![]() be the lease cash flow in period t. If we discount all cash flows with the same discount rate, the interest rate after taxes in our case, we can separate:

be the lease cash flow in period t. If we discount all cash flows with the same discount rate, the interest rate after taxes in our case, we can separate:

![]()

![]()

I prefer this separate analysis. This allows to take different discount rates for the cash flows with higher volatilities, or risks respectively, e.g. maintenance and salvage value. If you discount just the cash flow differences, you cannot do that easily. And you can proceed further analysis much easier with separate analysis data.

After you have decided whether you want do buy or lease, you probably intend do implement this decision in an overall project valuation. Then you have to transfer the corresponding cash flows in that valuation and discount with the same discount rates. This procedure can easily lead to failures if you do not use NPV with the component cash flow procedure as decision figure. If you discount the project with only one “company WACC” (project cash flow procedure) for example, this will provide false results. Additionally you can get implementation problems using project return rates as decision figure. But that is another story.