This is a simple example of an option to wait. We consider a 15 year project which requires an investment of 105 M€, that can be done anytime. Arbitrage Pricing Theory provides a yearly risk-adjusted capital discount rate (WACC) of 15%. Investment and internal risk cash flows are discounted by the risk-free rate. We assume for all years equal free net cash flow present values of 100/15 M€. Classical incremental cash flow analysis provides a present value of the market-related net cash flows of 100 M€. That means that the classic NPV of the project is -5 M€. Because of the negative NPV management should reject the project.

But management has an option to wait. It can wait with the decision and invest only if the market development is profitable. For sure the company loses revenues because of the delayed investment, but on the other hand management gets more information about market development. The question is: What is the value of this option to wait and how long should management wait with that investment decision? Can the project become profitable?

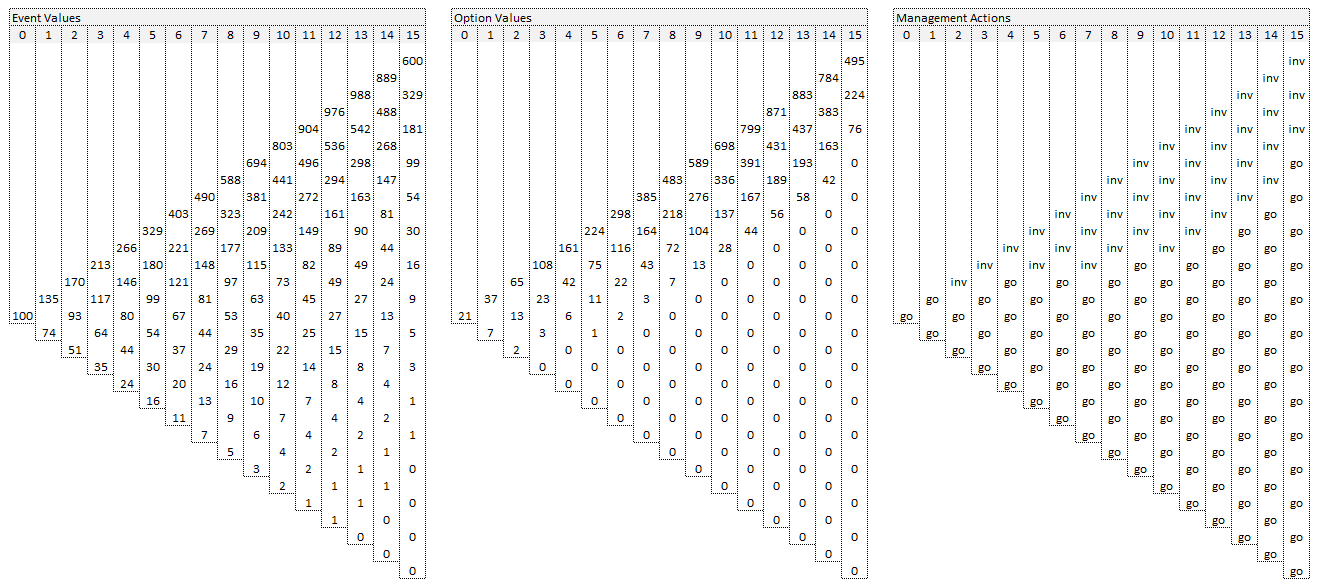

Monte-Carlo-Simulation of the project provides a project volatility of 30%. The risk-free rate is 5%. Next we are performing a real option analysis (ROA) of the waiting option with the binomial approach regarding 15 time steps, one for each year.

Real option analysis provides a project value of 21 M€. That means that the value added by the waiting option is 26 M€. Because the project value with waiting option is positive we should not reject the project any more. Management should go on with the project. Including the option in the project valuation leads to the opposite management decision. And besides the waiting option there might be additional options like the option to abandon or the option to expand/contract. They would bring additional value to the project.

Real option analysis also provides the information that there should be no investment done before the second year. Dependent from the market development management can decide when to invest according to the time value of the expected free cash flows.

In this example we assumed yearly cash flows that results in a decrease of the expected future cash flows. This corresponds to paying dividends at financial securities. Considering options in the lifetime of a project requires binomial valuation with leakage. If you assume relative leakage you get a recombining tree, with absolute leakage values you get a non-recombining binomial tree.