This is a simple example of a sequential compound option, which is typical in projects where the investment can be done in sequential steps. The option is valued by the binomial approach.

The project is divided into three sequential phases: (1) Land acquisition and permitting, (2) design and engineering and (3) construction. Each phase must be completed before the next phase can start. The company wants to bring the product to market in no more than seven years.

The construction will take two years to complete, and hence the company has a maximum of five years to decide whether to invest in the construction. The design and engineering phase will take two years to complete. Design and engineering has to be finished sucessfully before starting construction. Hence the company has a maximum of three years to decide whether to invest in the design and engineering phase. The land acquisition and permitting process will take two years to complete, and since it must be completed before the design phase can begin, the company has a maximum of one year from today to decide on the first phase.

Investments: Permitting is expected to cost 30 million Euro, design 90 million Euro, and construction another 210 million Euro.

Discounted cash flow analysis using an appropriate risk-adjusted discount rate values the plant, if it existed today, at 250 million Euro. The annual volatility of the logarithmic returns for the future cash flows for the plant is evaluated by a Monte-Carlo-Simulation to be 30%. The continuous annual risk-free interest rate over the next five years is 6%.

Static NPV approach: The private risk discount rate for investment is 9%. With that we get a NPV without any flexibility and option analysis of minus 2 million Euro. Because of its negative NPV we would reject the project neglecting any option flexibility.

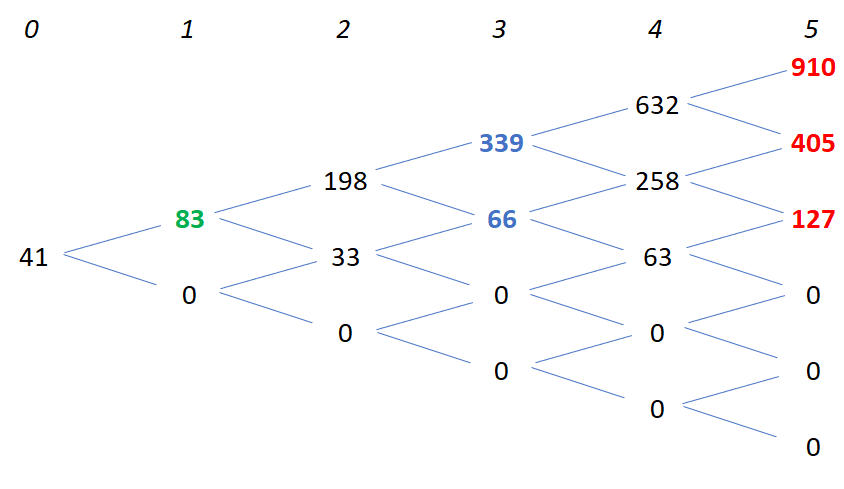

ROA: Considering the real options mentioned above we calculate a positive project value of 41 million Euro. That means that the compound options give an additional real option value (ROV) of 43 million Euro. Thus we should implement the project.

The real option analysis additionally provides the information when and under which market development to invest in each phase. The investment for the first phase should be done in year 1, for the second phase in year 3 and for the third phase in year 5. The option valuation tree tells management what to do in which market development.

The valuation can be done in smaller time steps to increase accuracy. But the purpose of this example is to illustrate the principle of a sequential compound option valuation.

Details are specified in Kodukula (2006), p. 146 – 156.