Joachim Kuczynski, 04 November 2025

This article is about an unusual sight on the CAPM beta. It provides a derivation from linear regression with the method of least squares. Often the definition of CAPM beta seems to be very abstract. But from the perspective of this article`s approach it might be clearer.

We assume a data set of market return rates ![]() and equity return rates

and equity return rates ![]() .

. ![]() indicates the

indicates the ![]() -th of

-th of ![]() data pairs.

data pairs. ![]() and

and ![]() are the arithmetic mean values of

are the arithmetic mean values of ![]() and

and ![]() . With the method of least squares we can make a linear regression that approximates the relationship with a linear function

. With the method of least squares we can make a linear regression that approximates the relationship with a linear function ![]() .

.

(1) ![]()

The slope ![]() of the linear regression function

of the linear regression function ![]() is given by:

is given by:

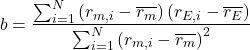

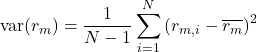

(2)

The covariance of ![]() and

and ![]() is given by:

is given by:

(3)

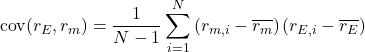

The variance of ![]() is given by:

is given by:

(4)

Substituting that in the expression for ![]() leads to:

leads to:

(5) ![]()

This is the same as beta (![]() ) in the Capital Asset Pricing Model (CAPM). That means that

) in the Capital Asset Pricing Model (CAPM). That means that ![]() is the slope of the linear approximated relationship of equity return rate

is the slope of the linear approximated relationship of equity return rate ![]() and market return rate

and market return rate ![]() using the method of least squares. In linear approximation we can state:

using the method of least squares. In linear approximation we can state:

(6) ![]()

In my point of view this is a very important point to know when doing investment analysis and using CAPM. It provides an additional interpretation of ![]() . This point of view is valid for all betas in general.

. This point of view is valid for all betas in general.